As is well known, public companies are legally required to provide clear and reliable information to their investors. But in reality, disclosures are sometimes incomplete—or even deliberately misleading. When that happens, investors can suffer unexpected losses. And too often, they assume there’s nothing they can do about it.

But that’s not entirely true. In fact, there is a way to recover some of those losses: securities class actions (SCAs).

SCAs serve as a key safeguard for investors. When a company’s misconduct or false statements lead to financial damage, investors can come together to file a class action—seeking compensation on behalf of everyone affected. And these cases are more common than you might think.

Between 2023 and 2025, more than 1,000 securities class actions were filed. In 2024 alone, 88 of them reached settlements—with a median payout of $14 million.

Understanding how these cases work—and staying informed when they happen—isn’t just about following corporate news. It’s about protecting your rights and making sure you don’t miss out on money that may be owed to you.

How Do SCAs Work?

A securities-related case doesn’t go straight to court. There are a few key steps that happen first—before it officially becomes a lawsuit. Here’s how it works.

Trigger Event

It all starts with what’s called a corrective disclosure—a public event or announcement that contradicts the company’s previous positive statements. This could be a poor earnings report, a short seller’s report, or internal problems coming to light.

These kinds of events often cause the stock price to drop, which leads to losses for investors.

Attorney Investigation

After the drop, law firms often begin investigating whether the company misled investors. While no formal lawsuit has been filed yet, this early stage lays the foundation for what comes next.

Even at this early stage, investors can join the case on 11th.com to follow updates and stay informed as the investigation unfolds.

Initial Complaint and Lead Plaintiff Submission

If the law firm decides to move forward, they file a complaint in court and the class action officially begins.

At this stage, investors can also apply to become the Lead Plaintiff—the person who represents all affected investors in the case.

Each case has a Lead Plaintiff deadline, which is the cutoff for applying to take on that role.

What does it mean to join the case?

When we say you can join a case on 11th.com, it means that you’ll get ongoing updates as the case progresses. We closely monitor legal filings and developments, so joining ensures you stay informed.

It’s also a way to make sure you don’t miss out on potential recovery opportunities. Roughly half of all SCA cases end in settlements, and joining early gives you the best chance to be included when that happens.

Joining doesn’t mean taking legal action or making any commitments—it just keeps you in the loop.

What does it mean to actively join the case?

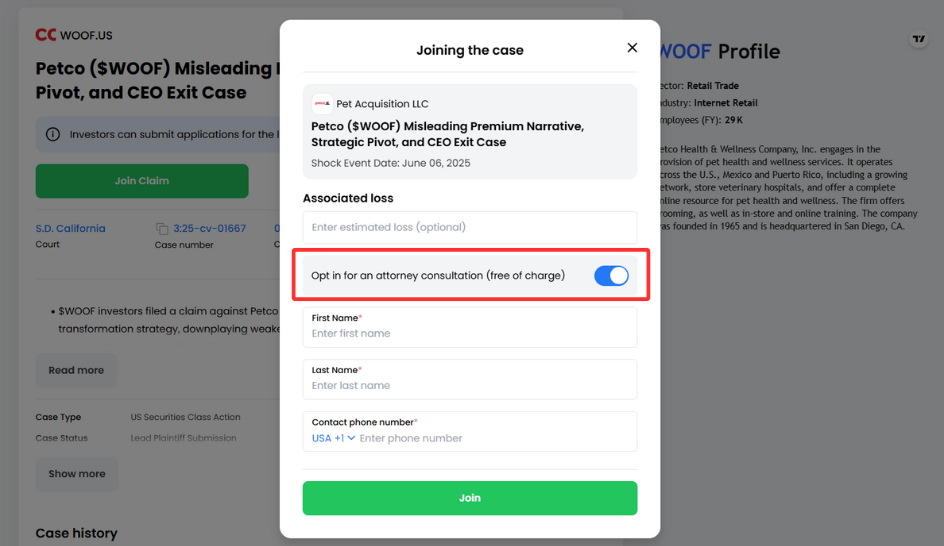

For cases that are in the investigation stage or still within the Lead Plaintiff deadline, you may see an option to take an active role.

This means you’re open to working directly with the law firm and possibly applying to become the Lead Plaintiff.

If you're interested, you can indicate it on the case page and fill out the necessary information, or contact us at support@11th.com—we’ll connect you with the legal team handling the case.

Note: 11th.com is not a law firm, and we don’t file lawsuits ourselves. Our role is to keep investors informed and connect them with experienced law firms that may take on their case.

What’s Happening in Court—and How It Could Lead to Your Recovery

Once the Lead Plaintiff deadline passes, the rest of the legal process unfolds. It can take anywhere from a few months to several years. Here are the main stages that shape the outcome.

Lead Plaintiff Appointment

The judge selects the most suitable investor to serve as Lead Plaintiff. This person represents the broader group of affected investors and works closely with the law firm throughout the case.

Motion to Certify the Class and Class Certification Result

Next, the court reviews the Motion for Class Certification to define the “class” — the group of investors affected — and establish the “class period,” which is the specific timeframe during which the alleged misconduct took place.

You can find class periods on all our case pages that are already in court—like this one.

Motion to Dismiss

At this point, the defendant—typically the company named in the lawsuit—may ask the court to dismiss the case. There are a few possible outcomes:

- Motion Denied: The court rejects the request and the case moves forward.

- Case Dismissed: The court agrees with the motion and ends the case.

- Voluntary Dismissal: Sometimes, the plaintiffs choose to withdraw the case themselves.

Settlement

If the court allows the case to proceed, companies often choose to settle rather than go to trial. Statistically, around 48% of securities class actions settle after the motion to dismiss is denied.

Discovery and Trial

If the company doesn’t settle, the case moves into the discovery phase and may proceed to trial. During this stage, both sides exchange documents, question witnesses, and build their arguments for court.

Why is it important to join the cases?

Currently, around 450 U.S.-listed companies are facing one or more active cases. In 2024, investors filed 225 securities class action suits—up from 215 the year before and 14% above the long-term average.

On 11th.com, you’ll find over 1,500 listed cases—including more than 100 settlements where investors can still claim compensation.

You can go through the cases yourself on our website or link your portfolio to get matched automatically. Once connected, you’ll receive updates on claims and settlements—so you never miss a payout or have to track anything manually.